HSN code finder – Your Simple Guide to Finding HSN Codes

Looking for the right HSN code for your product or service? The hsn code finder makes it quick and simple. Just type your product, click search, and get the correct code instantly — no stress, no confusion.

HSN Code Finder

Search HSN code & GST rate by product name

| Product | HSN Code | GST % |

|---|

Ever wondered how businesses figure out the right HSN code for their products? Or maybe you’re filing your GST return and you’re stuck wondering, “Which HSN code applies to this item?”

Don’t worry — the hsn code finder is here to help. It’s a simple online tool that helps you identify the correct HSN code for any product or service. With this tool, you can avoid mistakes, save time, and make sure your business stays compliant with GST rules.

In this guide, we’ll explain everything you need to know about the hsn code finder, including how it works, who should use it, tips for accuracy, examples, and why it’s so important.

What Is HSN Code?

HSN stands for Harmonized System of Nomenclature. In simple terms, it’s a code system that classifies products and services for tax purposes.

Every product has a unique HSN code, and using it correctly is essential to:

Apply the correct GST rate

Simplify filing of tax returns

Help customs in export/import processes

Standardize trade across India and globally

The hsn code finder makes this process easy by letting you search and find the exact HSN code for your products in seconds.

Why You Need an hsn code finder ?

You might ask, “Why can’t I just guess or check a list manually?”

Here’s why the hsn code finder is essential:

Quick results: No need to go through long tables or PDFs.

Error reduction: Wrong codes can lead to fines and GST mistakes.

Saves time: Especially for businesses with many products.

User-friendly: Works for beginners and experts alike.

Compliance: Keeps your business following tax rules properly.

Whether you sell offline or online, the hsn code finder helps you avoid mistakes that could cost time and money.

How Does an hsn code finder Work?

Using an hsn code finder is simple:

Go to the HSN finder website.

Type your product or service name in the search box.

Click “Search” or “Submit.”

View the suggested HSN codes.

Choose the code that matches your product best.

Some tools also let you filter by categories or compare similar codes. For example, if you type “cotton shirt,” it might show multiple codes, and you can pick the most accurate one.

Who Should Use It?

Almost everyone in business can benefit:

Shop owners

Online sellers

Manufacturers

Chartered accountants (CAs)

Tax consultants

Customs agents

Even if you’re just starting, the hsn code finder makes it much easier to classify products correctly.

Benefits of Using hsn code finder

Here’s why this tool is so helpful:

1. Time-Saving

Typing a product name and clicking search is much faster than flipping through long tables.

2. Reduces Errors

Wrong HSN codes can lead to GST mistakes. The hsn code finder ensures you get the right code every time.

3. Easy to Use

No technical knowledge is needed. Just type and click.

4. Improves Compliance

Using the correct HSN code keeps you on the right side of GST rules.

5. Great for Beginners

If you’re new to business, the hsn code finder saves you confusion and stress.

Example of How to Use hsn code finder

Let’s say you sell wooden furniture online.

Open the hsn code finder tool.

Type “wooden furniture” in the search box.

Click “Search.”

You’ll see the correct HSN code, for example: 9403

Now you know exactly which HSN code to use on invoices and tax returns. Simple, right?

Step‑by‑Step Guide

Here’s a clear step-by-step:

Visit an hsn code finder website.

Locate the search box.

Enter the name of your product clearly (like “leather bag”).

Press enter or click search.

Review the suggested codes.

Select the correct one.

Use it in GST invoices and filings.

Following these steps keeps your product classification accurate and saves you from errors.

Common Product HSN Codes

Here are some examples of common HSN codes you can find using the hsn code finder:

| Product | HSN Code |

|---|---|

| Cotton T-shirt | 6109 |

| Mobile Phones | 8517 |

| Laptop | 8471 |

| Leather Bags | 4202 |

| Wooden Furniture | 9403 |

Remember, the HSN code can vary slightly depending on product details, so always check with the hsn code finder.

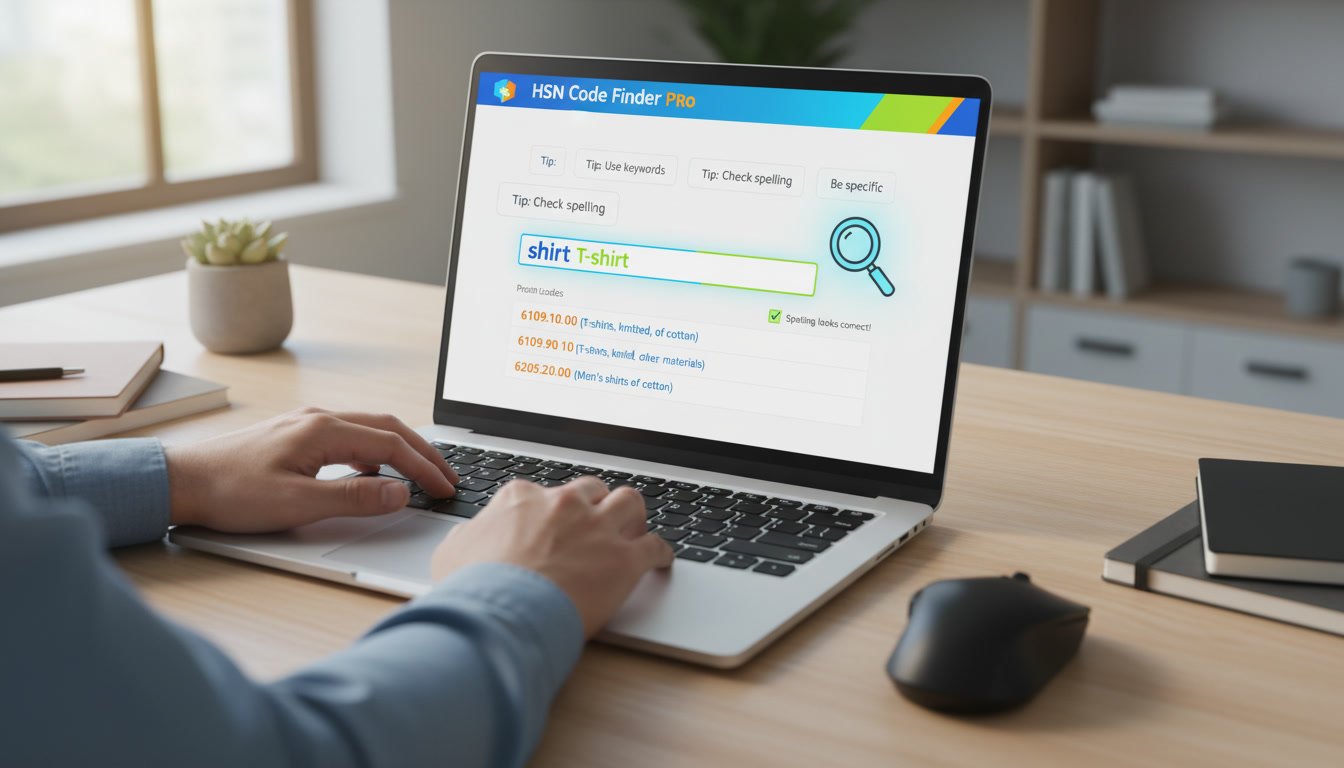

Tips for Accurate Search

To get the best results:

Enter clear product names.

Avoid spelling mistakes.

Try alternative terms if needed (e.g., “shirt” vs “T-shirt”).

Double-check suggested codes before using them.

For example, “red cotton shirt” may show the same HSN as “cotton shirt.”

Common Mistakes to Avoid

Some errors people make:

Using vague terms like “goods” or “items”

Not checking multiple suggested codes

Using old or outdated lists

Ignoring product details

Using the hsn code finder properly reduces all these mistakes.

When Should You Use hsn code finder?

Check your HSN codes:

Before filing GST returns

When listing new products

When products are updated or changed

Frequent checks ensure your tax data is always correct.

Mobile vs Desktop Usage

The hsn code finder works well on both devices:

Mobile: Fast searches on the go, easy for fieldwork

Desktop: Bigger screen, better for comparing multiple codes

Both options help you get the right HSN code quickly.

Using hsn code finder for Services

While HSN is mainly for goods, service codes (SAC) also exist. Many HSN tools include service codes too. You can search for services like:

Accounting

Consulting

Online courses

The hsn code finder helps you find service codes easily.

Export-Import Applications

If you export or import goods:

HSN codes are needed for customs clearance.

The hsn code finder helps classify products correctly.

Avoid delays and penalties with accurate codes.

Always double-check customs requirements, but this tool gives a strong starting point.

Benefits for Online Sellers

Online marketplaces like Amazon and Flipkart require correct HSN codes:

Speeds up product listing

Reduces GST errors

Improves compliance

Ensures smooth transactions

The hsn code finder is especially useful for sellers with many products.

Why Correct HSN Codes Matter ?

Using the wrong HSN code can cause:

Wrong GST tax rates

Errors in returns

Potential fines or penalties

Confusion during audits

With the hsn code finder, you get the right code every time, making business smoother.

FAQs for HSN Code Finder :

What is an HSN code finder?

An hsn code finder is a tool that helps you quickly find the correct HSN code for your products or services.Why should I use an HSN code finder?

Using it saves time, reduces errors, and ensures GST compliance.Is the hsn code finder free to use?

Many online hsn code finder tools are free, though some offer advanced paid features.Can I find HSN codes for services as well?

Yes, some tools include service codes (SAC) along with product HSN codes.How accurate is an hsn code finder?

Most tools are updated regularly and provide accurate results, but always double-check before filing taxes.Do I need technical knowledge to use it?

No. The hsn code finder is simple — type your product and click search.Can I use hsn code finder on my phone?

Yes, most tools work well on mobile and desktop devices.Does it cover all types of products?

Yes, good hsn code finder tools cover a wide range of goods and services.How do I search for a product?

Simply enter the product name clearly in the search box and click “Search.”Can I search multiple products at once?

Some advanced tools allow multiple searches, but most are designed for one product at a time.Do HSN codes change over time?

Occasionally, tax authorities update HSN codes. Always use the latest version of the hsn code finder.Can it help with GST invoices?

Yes, using the correct HSN code on invoices ensures proper GST calculation.Is it helpful for online sellers?

Absolutely. Online sellers can list products faster and avoid GST mistakes.Can exporters use it?

Yes, the hsn code finder helps classify goods correctly for export and import.What if multiple HSN codes match my product?

Choose the code that best describes your product, and check the description carefully.Does it reduce the risk of penalties?

Yes, using the correct HSN code reduces errors and potential GST penalties.Do I need an account to use it?

Most tools do not require registration for basic searches.Can it help beginners with GST filing?

Yes, beginners find it very helpful for understanding HSN codes and filing correctly.How fast is the search?

Results are usually instant — just type and click.Is there a difference between hsn code finder tools?

Yes. Some tools have extra features like service codes, category filters, or export/import options.